The 292-page exemption list also includes bicycles and carriages for disabled persons as well as various types of orthopaedic. A raw materials and components.

Malaysia Sst Sales And Service Tax A Complete Guide

However the decision on extending SST is up to the Finance Ministry says Transport Minister Datuk Seri Dr Wee Ka SiongThough he viewed the exemption as beneficial to the automotive industry he understood that the Finance Ministry.

. Mercedes-Benz Malaysia MBM has just sent us its revised price list ahead of the sales tax exemptionreduction scheme passenger cars that is set to take effect from June 15. As the SST gears up to make its re-entry into the Malaysian scene here is a list of 15 items which Malaysians will be glad to know are safe and SST exempted. Dairy products including milk cheese yogurt and more Butter Coffee Chili Sauce and Tomato Sauce Grains Tofu Kaya Sardines Tea Bicycles Ambulance Services.

Tailor optician engraving vanishing table top are some of the manufacturing activities exempted from registration regardless of the turnover. Live animals fish seafood and certain essential food items including meat milk eggs vegetables fruits bread etc. Buyers who registered their cars on or after 1-January 2022 will have to pay more irrespective of when they placed their orders.

1 Raw materials and components are imported or purchased from a licensed factory owner. 02021000 00 - Carcasses and half-carcasses. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya.

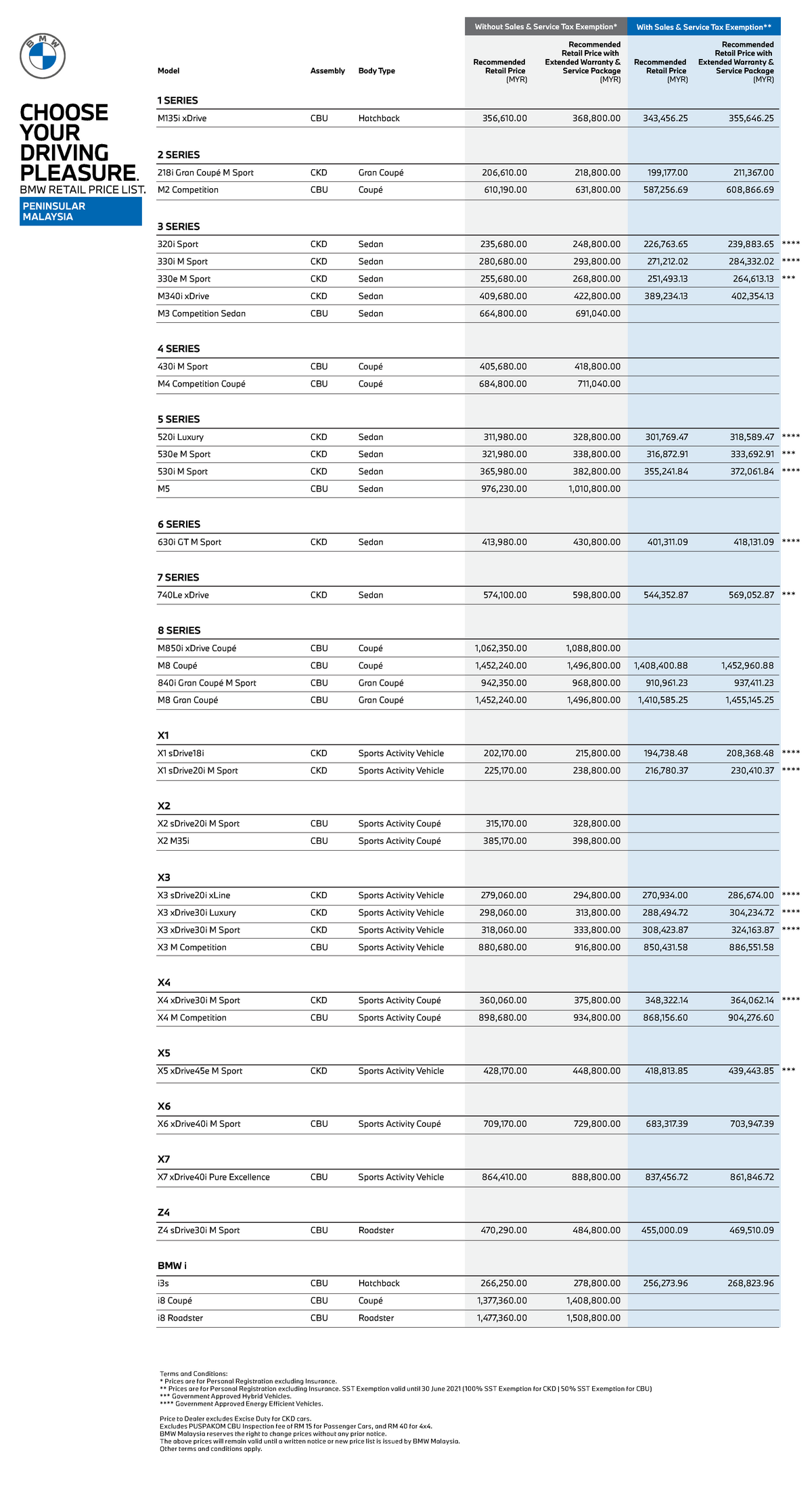

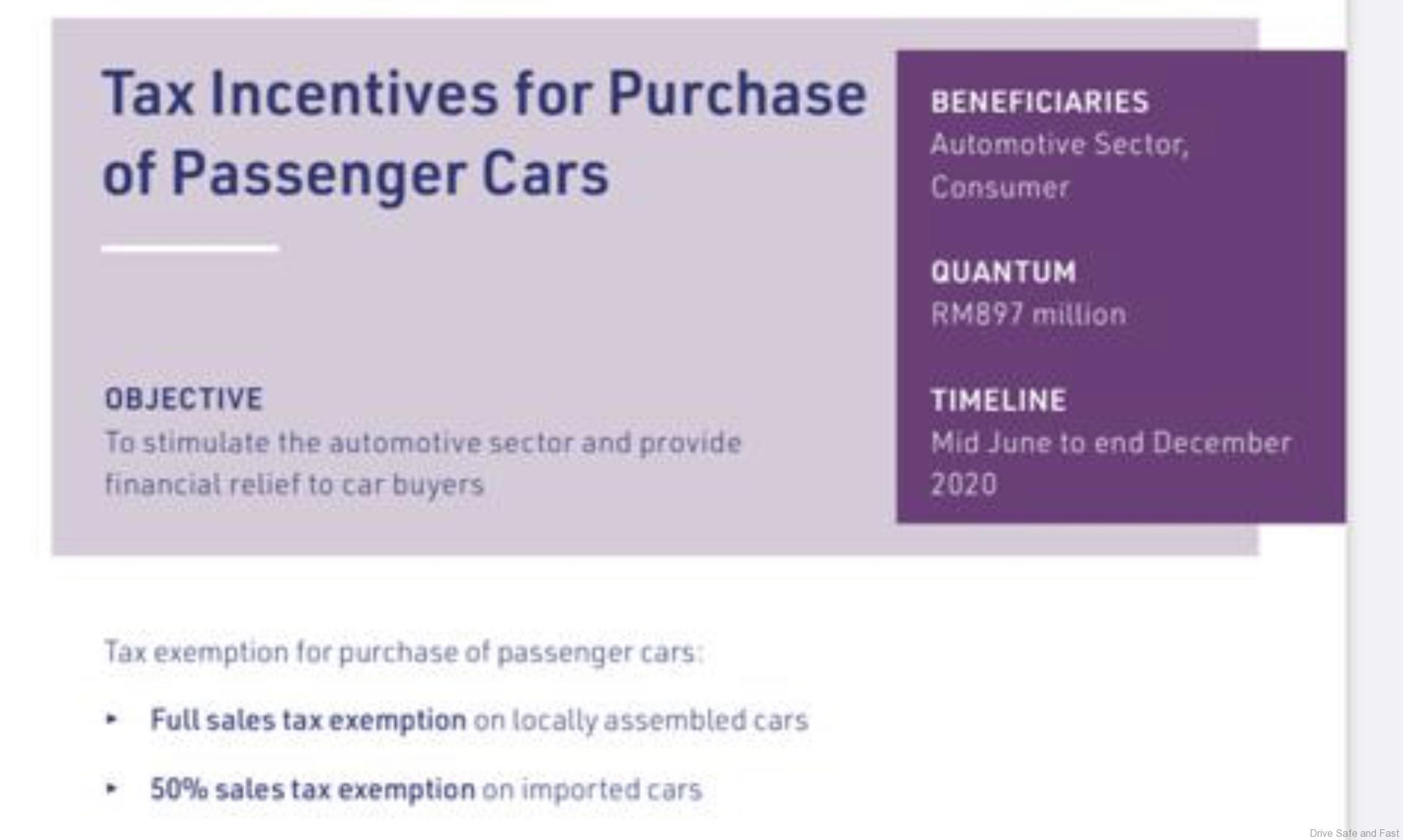

Prices shown are estimates. The SST exemption which is until Dec 31 2021 is 100 for locally assembled or completely knocked down CKD passenger vehicles and 50 for imported or completely built up CBU passenger cars. Website has informed that Ministers exemption for imported taxable service in Group G professionals will be applicable to any company in Malaysia who acquires taxable services of Group G items a b c d e f g h and i from any company within the same groupof companies outside Malaysia.

Life animals Eggs Spices Coffee and Tea Cereals Copra Ground Nuts Soybean Vegetables Extract Vegetables Plaiting and Other Vegetables Products Noodle and Pasta Prepared Animal Fodder Mineral Products Pharmaceutical Products Fertilisers. Under the SST exemption customers get a 100 percent sales tax discount on locally-assembled automobiles with a 50 percent sales tax discount on fully imported passenger cars. Come and check which tax rate does your item falls on through our blog series.

Trying to get tariff data. As it stands June 30th 2022 is the last day that the Malaysian government will be offering a 100 SST exemption on locally assembled passenger cars and 50 tax exemption on fully imported passenger cars though this has seen numerous extensions since the temporary policy was enacted on June 1st 2020. Sales Tax 5.

With such a massive. 2 The taxable service exempted is the same service provided by the service recipient person exempted from service tax payment. Books magazines newspapers journals periodicals etc.

Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. Malaysia Sales Service Tax SST. Meanwhile Maybank Investment Bank IB Research did not rule out the possibility of an SST exemption extension beyond end-2021.

The following goods are exempted from Sales Tax Live animals Unprocessed food Vegetables Medicines Machinery Chemicals Etc The following person are exempted from Sales Tax Schedule A. 3 The taxable service exempted is not for the service recipients own consumption but for. 5 Heading 1 Subheading 2 Description 3 02013000 00 - Boneless 0202 Meat of bovine animals frozen.

All Audi vehicle prices have been reduced as a result of the SST exemption. Products that are exempted from sales tax are live animals unprocessed food vegetables medicines machinery and chemicals. CERTIFICATE OF EXEMPTION 11.

To recap locally-assembled CKD cars are exempted from the 10 percent sales tax while fully-imported CBU cars get 50 percent discount 5 percent sales tax. The exemption approval will be granted with a certificate. The automotive sales and service tax SST exemption scheme is coming to an end on 30-June 2022 and there are calls for it to be extended.

Security Policy Site Map. The government first implemented the SST exemption in June 2020 for economic recovery and uptake of new car sales. Fully exempted from Sales Tax.

This facility is provided to provide tax exemption on raw materials and packaging materials used by local factory manufacturers to make tax exempted goods for the export market. If youre interested in a Honda weve compiled a list of Honda models to compare the prices with and without the SST exemptiondiscount. 11 rows HOW TO APPLY EXEMPTION UNDER SALES TAX PERSONS EXEMPTED FROM PAYMENT OF TAX 2018.

1 The service recipient and the service provider of taxable service exempted are registered for service tax. A list of consumer goods including poultry fish milk vegetables and various types of sugar has been proposed by the Customs Department to be exempted from the Sales and Service Tax SST when it is reintroduced. The exemption from payment of sales tax on such persons and goods will take effect when in respect of.

However there are some goods exempted from Sales Tax such as. The current exemption of the 10 percent sales and services tax SST for new locally-assembled passenger cars imported cars are taxed at a discounted 5 percent rate in Malaysia will expire by 31-December 2021. The generated certificate has a certificate number.

Savings start from RM7678 -349 for the Q2 sport and RM8390 -349 for the A3 Sedan all the way up to RM26201. Ruler of States Federal of State Government Department Local Authority Inland Clearance Depot Duty Free Shop. Class of person eg.

This facility is subject to the followings. Malaysia excludes designated area and special area 4 RATE OF TAX SALES TAX RATE OF TAX ORDER 2018 5 10 RM000lit 5 - reduced sales tax rate First Schedule in the Order 10 - default sales tax rate Specific rate for petroleum products Second Schedule in the Order RATE OF TAX 5 How to determine the rate of sales tax for goods. The complete list can be found on the SST Orders page of the MySST website.

Certificates of exemption are granted to applicants generated through MySST system.

What Are The Sst Exempt Ckd Cars You Can Buy In Malaysia In 2021 Wapcar

Complete Sst System Setup Guideline Help

Sst Simplified Malaysian Sales Tax Guide Mypf My

Goods And Person Exempted From Sales Tax Sst Malaysia

Malaysia Sst Sales And Service Tax A Complete Guide

Vat And Sales Tax Fastspring Docs

Malaysia Sst Sales And Service Tax A Complete Guide

Sst Simplified Malaysian Sales Tax Guide Mypf My

2020 Sst Lexus Malaysia New Price List Paul Tan S Automotive News

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Sales And Service Tax Sst In Malaysia

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sales And Services Tax Sst Mwta

Pm Bmw Price List 210421 Pdf Peninsular Malaysia Choose Your Driving Pleasure Bmw Retail Price Studocu

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

M Sian Govt Extends Sst Exemption Until 31 December 2021

Sales Service Tax Sst In Malaysia Acclime Malaysia